March 2, 2023

4 Steps for Driving Impact with Personalized Financial Wellness

Banks and credit unions have invested a lot of time and energy on money management solutions they hoped would foster customer engagement, leading to improved retention and greater business impact.

Unfortunately, the recent webinar I co-hosted with Forrester’s Peter Wannemacher revealed a large, uncomfortable gap between expectations and reality when it comes to money management. This finding from a Forrester survey of North American banks and credit unions was particularly alarming.

Yikes. That’s a problem. But … it can also be an opportunity if you move from the traditional offerings to what we call advanced money management.

5 Reasons Why Now Is the Time for Advanced Money Management

Providing advanced money management capabilities to customers is particularly critical in this current economic environment. There are several factors contributing to this urgency.

1. Rising Rates

Rising interest rates are putting more money in motion. That’s prompting customers to make choices about where they want to put their money – which accounts at which institutions.

2. The Shift to Digital Is Accelerating

This shift is putting pressure on FIs (financial institutions) to invest more heavily in digital capabilities, but unfortunately, many are saddled with legacy technology stacks that make it hard to push innovation.

3. Fintech Competition

Fintechs are developing new points of distribution, particularly embedded banking services that are picking off profit pools and delivering services that can compete with traditional banks.

4. Customer Demands

In response to a Personetics survey last year, bank customers and credit union members said they wanted personalized advice and money management support through their mobile banking app, as well as help with saving and understanding their cash flow. The biggest finding: More than half said they may switch to a competitor for better money management capabilities.

5. The Potential Payoff

If your money management capabilities meet those customer demands, there’s a tremendous upside. Recent analysis by McKinsey found that leading banks that have over 30% engagement around money management and advanced PFM capabilities show 175% higher sales per user and substantially higher monthly logins.

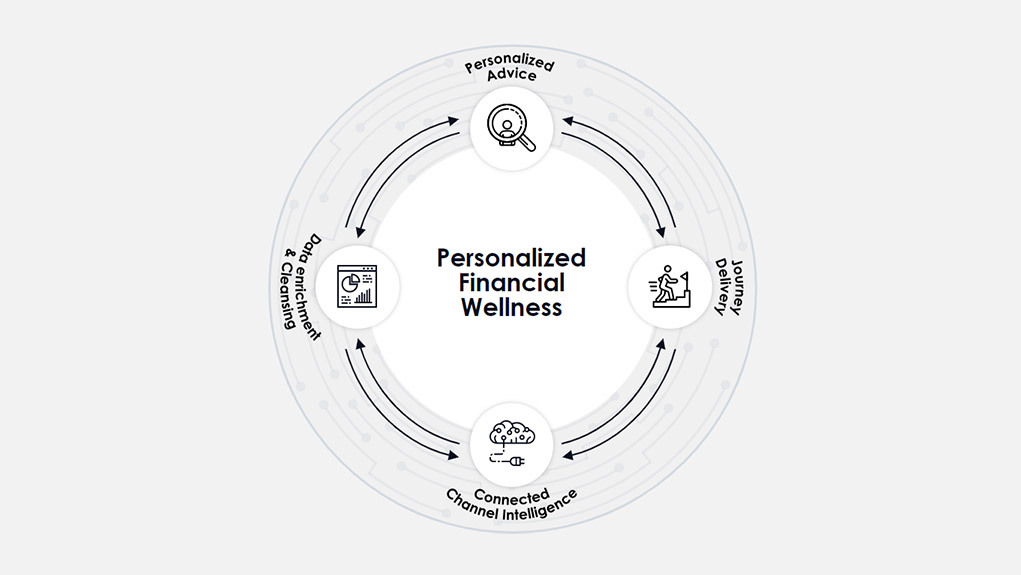

The Path Forward: 4 Steps to Personalized Financial Wellness

Before you jump into advanced money management, first recognize that financial wellness depends on the customer. The affluent customer trying to build wealth has different requirements than the customer who is living paycheck to paycheck. Thus, the need for personalized financial wellness. To deliver this, you need a multi-step approach, based on these four steps.

1. Data Enrichment

Data enrichment (and cleansing, and categorization) is interpreting customer transaction data and using it for analysis around insights that are relevant to customers. This also helps customers understand their transaction data, by identifying transaction counterparties and providing logos, locations, and websites. Data enrichment clarifies where spending occurred and how much was spent, reducing call volume at customer service centers.

2. Personalized Advice

Personalized advice involves delivering intelligent, proactive, contextual insights tailored to what the customer needs to know and act on, at that moment.

This could be around transaction monitoring – looking for anomalies in transaction activity. Or it could be about managing the customers’ subscriptions, alerting them when they have multiple subscriptions in the same category, or when a free trial for a subscription is about to end.

It can also help customers better understand their cash flow, so they can know, for example, when they will have enough to cover expenses over the next 30 days and can safely transfer money to their savings account.

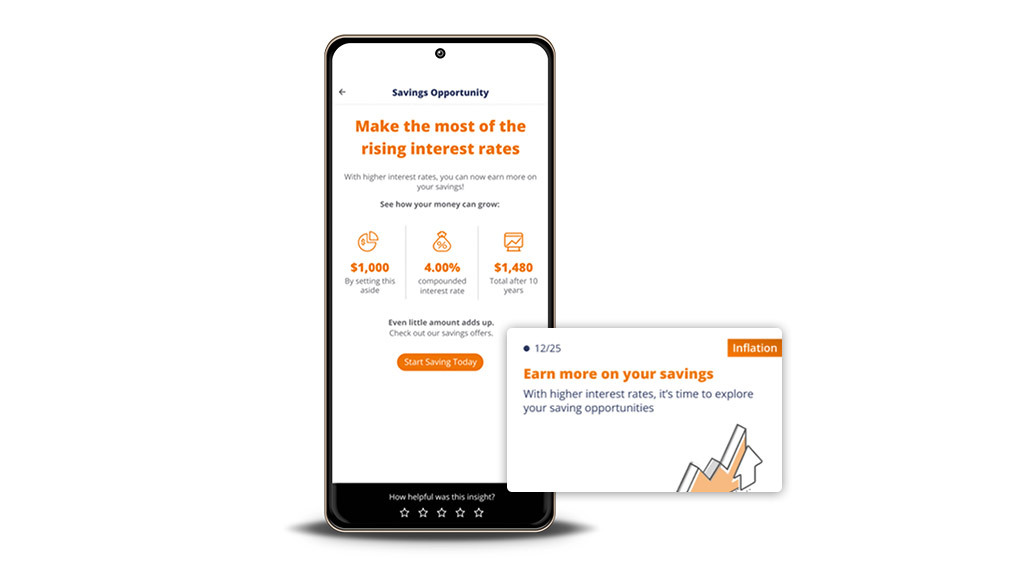

One more example: A bank could provide inflation insights. As we noted earlier, customers have more choices with their money, so you could introduce them to products that can help them make more from their savings – giving them an alternative to sending money out of your institution.

3) Journey Enablement

The next step, journey enablement, can also be thought of as “jobs to be done.”

Personalized insights create value by identifying what should I do right now, but customers have certain jobs to be done – building up emergency savings, managing spending, growing wealth, paying down debt, etc. – that they may be working on for several years.

First, your FI must recognize the need. Next, enable a journey for each customer, with a tailored set of products and tools that can help them accomplish that job.

Third, and most importantly, show customers how they’re progressing towards that goal. Reinforce positive behavior and provide options when they’re not making progress.

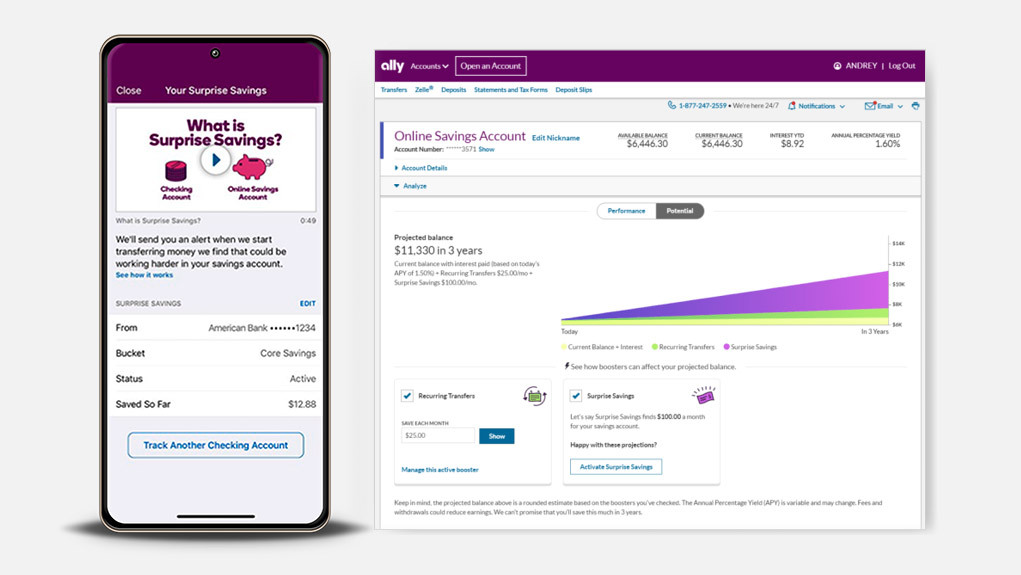

Here’s how Ally Bank helps with saving toward a goal.

They have a powerful capability called Savings Tools, which includes features like savings envelopes and “Surprise Savings,” that help customers save more effectively. Ally has publicly stated that 600,000 of their more than 2M customers use some form of their savings tools. Those customers are two times more likely to have multiple Ally products.

4. Connected Channels

The last step is around connected channel intelligence. In many institutions it’s not just about the digital experience; there’s a critical human experience as well. You need the right customer financial intelligence delivered not only through your digital channels but also to your bankers and into your martech stack.

Customer financial intelligence can answer all sorts of critical questions. Is the relationship primary or secondary? What’s the customer’s transaction volume? What are their balance trends? What are their sources of income and how stable are they? How many cash flow issues have they had? Do they have the capacity to save or invest every month? If so, where’s that money going? And so on …

All this customer financial intelligence can be synthesized into specific events and opportunities that are delivered digitally to the customer, the banker and your martech stack, for customer marketing.

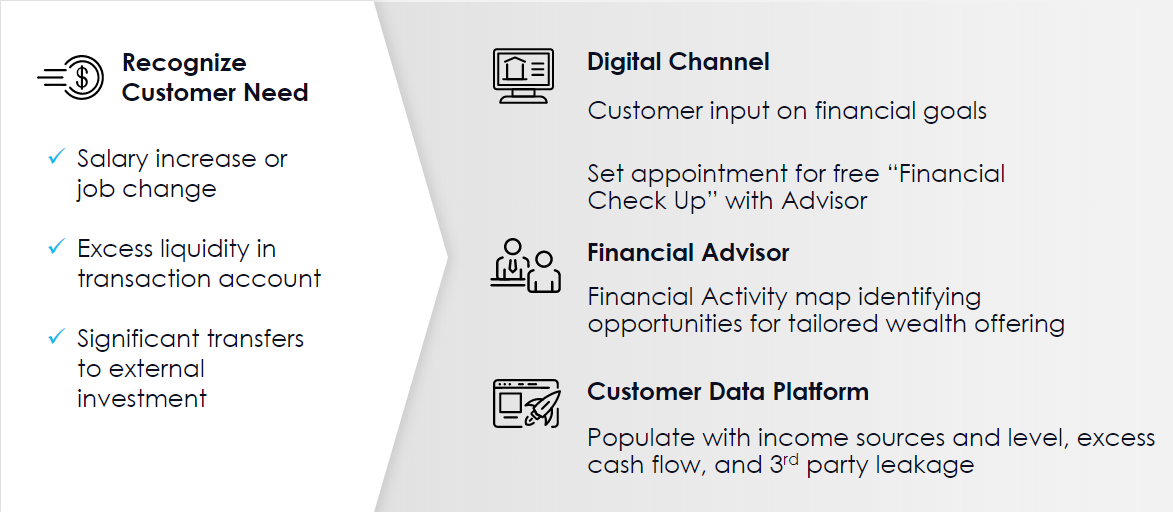

Here’s how that might work.

Let’s say our data enrichment tells us that a customer has a new source of income – perhaps a job change. They are keeping excess liquidity in their transaction account – much more than what’s needed to cover their expenses – and they’re moving money outside the institution every month.

In the digital channel, we’ll ask them if they’re saving for a goal, and if they want to set up an appointment with a financial advisor.

Parallel with that, we’ll arm the financial advisor with all this customer intelligence, and a financial activity map showing why this is an ideal customer for our wealth and savings offerings.

On a third track, we’ll send this information into our customer data platform, or equivalent system. This can then be used to deliver targeted, personalized marketing outreach.

A Personalized Financial Wellness Approach Starts with Leadership

So how do you get started on creating this multi-step approach to financial wellness for your bank or credit union?

On a recent episode of our Banking on Innovation podcast, Hans Morris, the managing partner of Nica, said: “I don’t see this as a technology problem. It’s a leadership issue in organizations that innovate at pace … In organizations that innovate at pace, the CEO and management team take ownership and are aligned on what they’re trying to achieve.

Your leadership needs to view hyper-personalized financial wellness as something customers value and something that produces tangible gains for your organization. That involves providing a set of advanced capabilities and a way of operating that is more intelligent and proactive and focused on helping improve customer financial well-being.

Do that, and you will soon have a stronger customer franchise with better business outcomes.

Request a demo today to discover how Personetics can help your bank drive business impact and customer engagement through personalized financial wellness.

Want To See How Cognitive Banking and AI Can Transform Customer Engagement?

Request a Demo Now

Latest Posts

Meet Personetics at North America Banking & Fintech Events in 2026

Meet Personetics at LATAM Banking & Fintech Events in 2026

Meet Personetics at APAC Banking & Fintech Events in 2026

How to Monetize AI While Building Trust

Cognitive Banking, Primacy, and the New AI Playbook for Banks: Insights from Money 20/20

How to Prevent Churn & Grow Wallet Share: Bank Primacy Playbook

Jody Bhagat

President of Americas, Personetics

Jody brings deep operating experience in financial services – managing direct channels, launching digital ventures, and leading digital transformation programs. He was previously a Partner at McKinsey & Company, where he helped financial institutions define and execute digital transformation programs to drive customer growth and operating efficiency. Jody also served in senior digital operating roles at U.S. Bank, Wells Fargo, and Providian. In these positions, he led digital sales and service functions and direct to consumer businesses to deliver organic growth and enhanced customer experience. Jody has an MBA from Northwestern University and a BS in Computer Engineering from The University of Michigan.