October 22, 2020

Personalized Engagement: The Key to Customer Experiences that Drive Growth for Banks

Ben is 22 and coming up on the one-year anniversary at his first job as a Project Assistant at a software company. He rents an apartment in Boston where rents have risen significantly in recent years. While he has just entered a profession with high earning potential, student debt combined with a high cost of living leave little cash at the end of the month. Plus, personal financial management isn’t exactly taught in engineering classes.

To make matters trickier, COVID-19 has put Ben’s job into question, making it even more important for him to build a savings buffer and make sure he is set up for potentially challenging times ahead. How can Ben manage his personal finances more effectively, get on the right track toward paying off his debt, and maybe even start to save toward future purchases he’d like to make, like a new car and, later, a house?

What Do Today’s Retail Banking Customers Need?

Ben represents the average retail banking customer today. Between 40-50% of retail banking customers spend their entire income each month. They need assistance with three main challenges:

- Managing spending

- Paying down debt

- Buffering savings

And, with their life more digitized than ever before, retail banking customers today have evolving expectations from their bank. They want their bank to help them cultivate financial resilience in an uncertain world. They view their bank not as a safe, but as a trusted partner in managing finances. And with consumer tech touching nearly every aspect of their lives, they expect their bank to keep up; to engage them with intuitive, intelligent digital experiences.

Ben certainly thinks this way. Alexa advises him every morning on that day’s weather, and that afternoon would be a good time to get his daily run in. Why can’t his bank give advice about where he should spend his money, and when to save it?

How Banks Deliver Personalized, Valuable Customer Engagement Experiences

While a bank’s most valuable asset is its customer, most banks still fail to deliver exceptional customer experiences that bring quantifiable engagement and value to customers’ financial lives. And while banks understand that more engaged customers spend more time interacting with the bank, they lack the strategy or tools to convert that engagement into positive ROI.

Personetics can help them do that through a comprehensive solution built of financial data-driven personalized insights, actionable advice, and real-time recommendations that banks can implement quickly and without a heavy in-house development investment. Let’s see how implementing Personetics’ offerings would support Ben in developing financial resilience early that will serve him throughout his life:

- To help Ben manage spending, he can receive notifications through his banking app, based on his personal, actual transaction data, that increase his awareness of his spending, double charges, and can recommend easily implementable changes with the click of a button.For example, with Personetics’ Insights, banks can notify Ben that he is concurrently paying two streaming music memberships. By cancelling one, Ben could save hundreds of dollars per year—a significant amount toward a longer-term goal like buying a car. Moving beyond individual insights, Personetics Smart Savings is a Financial Wellness Program that takes a wider view of Ben’s finances, engaging him for the long-term to reach a more significant personal goal like buying a house. With notifications on spending anomalies, alerts when he approaches a danger zone, and suggested alternate ways to save, Ben is actively moving closer to his financial goals.

- More than once, Ben has forgotten the monthly deadline for his student loan payment. To help him pay down debt faster and without incurring late fees, Personetics’ advanced algorithms analyze his transaction history and learn that his on-time payments tend to occur on the 10th of the month. Next month, Ben’s banking app would suggest making the payment on the 10th and, if Ben risks going into overdraft because of that payment, offer to move funds between his accounts to maintain a positive balance. The app will also take that recurring payment into account as it analyzes the account and will “set funds aside” to ensure Ben has enough money in his account for the payment.

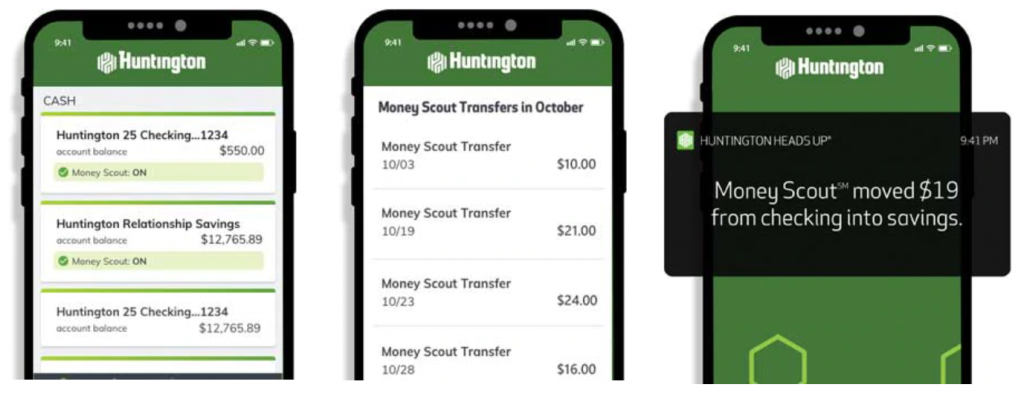

- Say that several months later Ben has his spending and recurring payments in order and feels more in control of his finances. He was also just promoted to Project Manager and his salary increased by 10%. He is ready to take his savings goals more seriously but needs guidance.Personetics’ Pay Yourself First Program helps customers prioritize savings by setting a predetermined amount aside monthly when a salary or other recurring payment is deposited. Unlike manual savings programs which see low adoption rates because they put the onus on the customer to take action, automated programs work on the customer’s behalf. Ben’s bank analyzes his spending habits, income, and upcoming expenses, finds pockets of available funds, and automatically moves them into savings. Programs like Huntington Bank’s Money Scout saved customers like Ben an average of $115 per month.

With Personetics, Ben’s bank understands his behaviors and preferences; crafts personalized insights and advice; analyzes his actions as they evolve; and tailors future suggestions accordingly, all in an effort to assist Ben in building the financial health he needs through the excellent digital experience he expects.

What’s in it for Ben’s Bank?

What about the bank? Why should Ben’s bank care about the satisfaction of a young, not-yet-wealthy retail customer? By developing Ben’s healthy financial habits at a young age, the bank positions itself as his long-term trusted financial advisor, and he becomes a more engaged customer. Engaged customers typically account for 2.4 times more revenue than neutral ones, according to research by Peter Kriss at Harvard Business School. Ben becomes more likely to buy additional products and services as his wealth grows, which translates to tangible improved outcomes for his bank.

McKinsey lists three key customer engagement metrics that an AI-based digital banking strategy impacts: higher efficiency, increased access and scale, and higher customer lifetime value. Personetics’ offerings impact all three of these metrics.

In terms of increasing efficiency through more cross-selling, Personetics’ programs lead to 15-20% growth in new accounts and a 5-8% improvement in customer retention. Customers of banks that use Personetics’ solutions also reach selling points faster and at a greater scale, with a 17% click-through rate on tailored product and service suggestions, and 35% more engaged customers. They are also more satisfied, with a 7-point NPS increase, and an average 4.4 out of 5-star rating across all customer segments, products, and services.

Even as branch visits dwindle and banks struggle to demonstrate their personal touch, Personetics’ personalized engagement and digital automation solution make Ben feel that his bank meets his needs, and that his financial wellbeing is tended to. Customers who feel that way stay with their bank through uncertain times and beyond.

Want To See How Cognitive Banking and AI Can Transform Customer Engagement?

Request a Demo Now

Latest Posts

Meet Personetics at North America Banking & Fintech Events in 2026

Meet Personetics at LATAM Banking & Fintech Events in 2026

Meet Personetics at APAC Banking & Fintech Events in 2026

How to Monetize AI While Building Trust

Cognitive Banking, Primacy, and the New AI Playbook for Banks: Insights from Money 20/20

How to Prevent Churn & Grow Wallet Share: Bank Primacy Playbook