March 31, 2022

Personalization, Sustainability, and Business Impact: 5 Key Takeaways from FinovateEurope 2022

Attending FinovateEurope was a powerful reminder that our industry is going through an era of fundamental change. The banking leaders at this event were not only discussing how to take their brick-and-mortar offers into the digital world, but how to completely evolve their business model for a new generation of digital native customers.

And while financial institutions have always been focused on the needs of their customers, there was a noticeably greater emphasis on how to create a customer-centric experience that supports peoples’ financial wellness.

Keynote speaker David Brear, Co-Founder of 11:FS, illustrated the power of this shift with two quotes from Jamie Dimon, long-time CEO of JPMorgan Chase.

In 2016, Dimon said: “I’m not nervous about fintech changing the way people are changing their banking habits.”

By last year, he’d changed his tune: “Banks should be scared sh**less about fintech challengers.”

At Personetics, we believe that banks do not have to fear fintechs. Instead, banks have a special opportunity to partner with fintechs to change the way they compete. By embracing digital transformation, financial institutions can evolve their role at the center of the customer’s financial life, and transform their business model from transaction-based sellers of products to a proactive role as “trusted advisors” to their customers.

When banks truly know their customers, by analyzing customer transaction data, they can provide personalized insights, relevant recommendations, and product-based advice – in a way that unleashes value for customers and drives business impact for financial institutions.

Here are our top 5 takeaways from what we heard at FinovateEurope 2022:

1. Banks are Evolving Toward Personalized Service (Again)

When the banking industry first began its journey from analog to digitization, noted David Brear, it tried to de-personalize the customer experience. For example, instead of getting statements delivered to your home, you could view them online or on your mobile app.

Unfortunately, this digital transition had some unintended consequences, as David Brear said: “They tried to take people and paper out of that process. And I mean people in a real sense, but I [also] mean humanity and empathy in a real sense, in terms of what’s delivered to consumers.”

But now we’re coming full circle. Being fully digital means moving from commodity analog products to intelligent digital services which provide customers with an experience that feels intensely personal. FIs can combine the best of the friendly neighborhood banker with advanced digital capabilities to deliver digital plus human interactions.

Brear described the future of banking as a self-driving car, which uses algorithms to help customers manage their money even better than they can by themselves. This is perfectly aligned with Personetics’ mission of Self-Driving Finance. Our vision is a world where financial institutions use data analytics, machine learning, AI, and customer transaction data to automatically help their customers improve their financial wellness with advanced Money Management capabilities.

We are already helping banks analyze their customers’ spending and saving patterns, and use the information to give them personalized insights, financial advice and even automated money management – for example, moving spare cash into a savings account based on the customer’s cash flow.

The new competitive battleground in financial services is focused on how financial institutions can engage more closely with customers, driven by the customers’ own transaction data. Banks are providing personalized service and becoming their customers’ trusted advisors once again.

2. Financial Services Innovation is Being Driven by Customers

In the early stages of digitization, banks innovated in order to keep up with their competitors. More recently, the pressure for innovation is coming from the customers themselves. This is partially because the pandemic has caused more customers to use digital channels, raising their expectations for digital banking experiences.

It’s also a generational shift.

“Most of the financial system was built between the 1950s and the 1970s-80s,” said Ronit Ghose, Global Head of Banking, Fintech & Digital Assets for Citi Global Insights. “What we’ve done is taken the existing financial system and put it onto this Internet economy. And an entire generation of people have grown up as Internet natives and they simply don’t understand why financial services works the way it does…”

Part of this shift in customer expectations can be seen in how financial institutions are helping their customers to save money and manage money automatically. Santander UK invested in Personetics’ financial data-driven personalized engagement platform after its customers expressed concern that they were missing opportunities to save, Andy Warren, the bank’s Head of Digital Transformation, told the conference.

Over the past three years, more than 2 million Santander customers have engaged with the My Money Manager app, which helps people become smarter about their spend by sending them personal insights and alerts, and automating some of their savings decisions.

And customers continue to drive its evolution, as Santander gets constant feedback about the insights, showing how customers are benefiting from this personalized digital banking experience.

“The unique thing is that customers can give feedback – we get thousands of responses each day,” Andy Warren said. “Then that goes into the development of the product and how we optimize the insights moving forward.”

Actual customer feedback for Personetics insights

3. Banks are Increasingly Conscious of their Social Contract

Customers expecting more proactive help managing their finances is, in one sense, a technical challenge for banks. How do banks develop the IT and algorithms to make this possible?

But it should also prompt banks to examine more deeply the kind of role they want to play in their customers’ lives. How much responsibility do they have to improve their customers’ financial wellness?

Zil Bareisis, head of Retail Banking Research at Celent, told Finovate that this discussion is underway: “Banks talk about purposeful banking. They’re looking to understand, what is it that they really stand for?”

After many years of banks focusing on technical questions like how to improve money movement in-app, this introspection about mission and purpose is relatively new, but necessary. Society increasingly demands that organizations uphold a social contract to make a positive impact on the world.

Personetics’ financial data-driven customer engagement platform enables banks to fulfil their social contract by actively improving people’s financial wellness. Instead of a transaction-based business model of charging fees and selling products, financial institutions can serve a higher purpose as “trusted advisors” that help people improve their financial condition.

Customers are expecting more from the banking experience, and FIs now have the capabilities to offer their customers a supportive, personalized experience with smarter spending, better insights into cash flow, and automated savings, debt management, and investments.

As the cost of living, inflation, and interest rates spiral upwards, expect to hear much more about banks’ moral responsibility for their customers’ financial resilience. Financial institutions will need to demonstrate how they are supporting their customers in good times and bad, and how they are helping their customers establish a stronger financial future.

4. Banks Want to Support Sustainability – But Are Not Sure How

The rise of ESG investing, environmental activism, and public concern about climate change have led to socially conscious consumers demanding that brands take action to be more environmentally friendly. The banking sector is part of this larger trend of intensifying concern about climate, carbon emissions, and sustainability.

Oliwia Berdak, a vice president and research director in Forrester’s financial services practice, said that banks see this as an opportunity to reconnect with customers: “COVID-19 revealed inequities in health and society. A lot of banks want to be part of that agenda too and build back better… Banks and fintechs have a strong role to play. If you think about the environment and ESG broadly, this kind of transformation will require transformation of products and services for customers, but also policies and processes that a lot of these institutions have in place.”

However, while there’s huge goodwill and an influx of money and innovation being directed at sustainability, banks are still searching for practical ways to integrate this vision into their offering.

As part of the Personetics Engage offering, financial institutions can deploy advanced capabilities that show their customers the carbon emissions of every transaction and help automatically guide customers toward climate-friendly financial goals. We believe that it’s not good enough to just show people the carbon footprint of their purchases; instead, financial institutions should proactively help their customers make better-informed choices to reduce carbon emissions as they manage their money.

Personetics’ sustainability-focused solutions highlight and compare the different carbon footprints of different purchases, so people can make an informed choice to reduce the climate impact of their spending. Our solutions also help FIs encourage their customers to set up climate-friendly financial goals, like saving up for solar panels or an electric vehicle. Customers who show interest in reducing their carbon impact can also be shown recommendations for relevant products and ESG investment funds.

Andy Warren, Head of Digital Transformation at Santander UK, said that these capabilities are popular among customers who “want to do the right thing but need the tools.”

And he predicted that the next priority for socially conscious banks will be making digital banking services more inclusive to help reach customers who have been traditionally underbanked or underserved: “This type of capability levels things up [for] those that are not as financially literate, or vulnerable customer segments. Artificial Intelligence will help customers who have needed that support but have not been able to access it through traditional services.”

5. Business Impact is Returning to Center Stage

For the past decade, financial institutions have focused on cost-cutting. Now we’re seeing a shift towards business impact and revenue generation. As customers flock to digital channels, FIs are not only asking how to engage with them but how to monetize their customer relationships with better cross-sell targeting and bigger Customer Lifetime Value.

Forward-looking banks are changing their model, moving from a passive, reactive approach to a more proactive “Money Management” role. They harness customers’ transaction data to better understand their cash flow, spending patterns, and financial goals, and help customers make the right financial decisions at the right time.

This ongoing engagement and interaction with customers creates deeper, more trustful relationships, increasing Customer Lifetime Value and allowing banks to cross-sell relevant services and make personalized recommendations. Since so many banking services and account products have become commoditized with similar features and interest rates, offering a personalized experience with relevant advice is also an ideal way for banks to differentiate themselves in a competitive market.

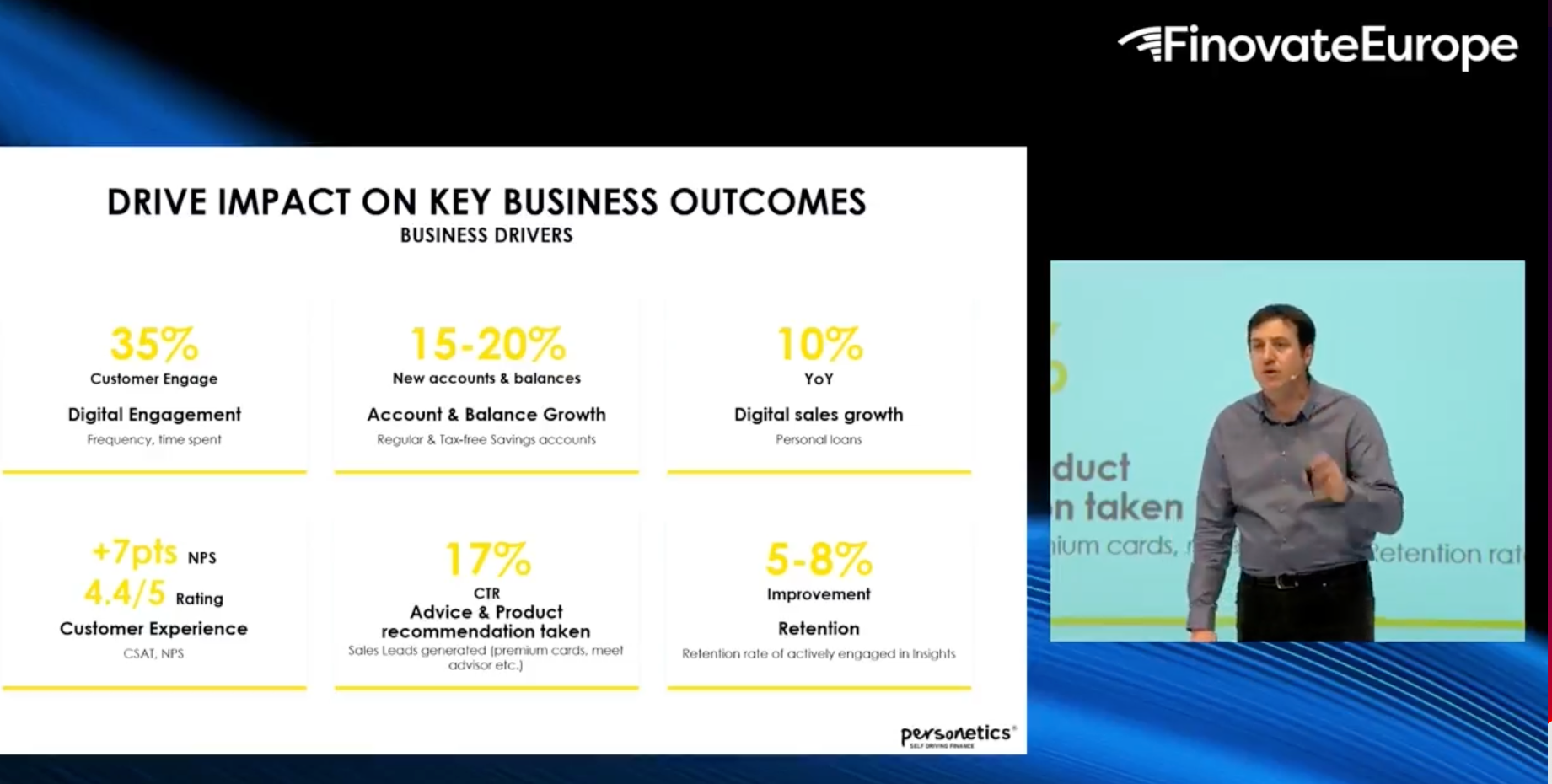

In my own session at FinovateEurope, I shared the bottom line impact on the 80 banks Personetics supports across 30 markets. On average, they see a 35% increase in customer engagement and 15-20% growth in new accounts. Critically, there is also 5-8% growth in retention.

Dorel Blitz presents business impact KPIs at FinovateEurope 2022

Increasingly, banks understand that it’s almost impossible to achieve such results alone.

Christoffer Malmer is former co-head of the Corporate and Customer Division at SEB, a leading Nordic corporate bank. Now head of SEBx, its innovation group, he said that it was difficult to deliver ambitious KPIs while driving disruptive innovation at the same time. Getting the technology right, he said, was a momentous task which involved “process, the way you design things, working in agile way, attracting talent… All of a sudden you find yourself competing with the new breed of technology providers.”

To shift your business model, banks must focus on their own strengths, while collaborating with and drawing on the expertise of fintechs – like Personetics.

The future of digital banking will see increasing collaboration between financial institutions and fintechs. We believe that FIs have a leading role to play at the center of their customers’ financial lives, and they already have the customer transaction data that can serve as the foundation for breakthough innovation. By embracing a new role as trusted advisors, by providing advanced Money Management capabilities, and by focusing on what they do best – knowing their customers, advising their customers, and offering relevant personalized insights and helpful recommendations to their customers – financial institutions can lead the future of digital banking.

Ready to see how Personetics can support your institution with advanced Money Management capabilities? Request a demo.

Want To See How Cognitive Banking and AI Can Transform Customer Engagement?

Request a Demo Now

Latest Posts

How to Monetize AI While Building Trust

Cognitive Banking, Primacy, and the New AI Playbook for Banks: Insights from Money 20/20

How to Prevent Churn & Grow Wallet Share: Bank Primacy Playbook

How to Maximize SaaS Value and Future-Proof Your Platform

Truist's Performance Marketing Journey: From Merger Challenges to Million-Dollar Results

How Asia Pacific Banks Are Redefining AI-Driven Engagement

Dorel Blitz

VP Strategy & Business Development

Dorel Blitz brings over 13 years of experience in global strategy and business development in the financial services industry. Dorel joins Personetics from KPMG, where he headed the Fintech sector at KPMG Israel and a member of the global Fintech practice. In this role, Dorel was instrumental in establishing KPMG’s collaborative relationships with global financial institutions and leading Fintech companies including Personetics. He also acted as a subject matter expert and led advisory projects involving digital transformation strategies with financial services organizations. Prior to joining KPMG, Dorel led the Innovation & Fintech practice at Bank Leumi, and earlier in his career he headed the banking & finance division at global research firm Adkit.