November 26, 2024

Engagement Marketing Masterclass: Taking Data-Driven Personalization to the Next Level

Beyond transactions: Synovus Bank reimagines banking with the power of personalization

By Jody Bhagat, President of the Americas, Personetics

The Financial Brand Forum in May 2024 was attended by over 2,000 banking industry participants, and I had the pleasure of co-presenting with Liz Wolverton, EVP and Head of Consumer Banking and Brand Experience for Synovus Bank. Our session, “Engagement Marketing: Taking Data-Driven Personalization to the Next Level,” explored a new concept of how to engage customers and deepen relationships. I call it Personalized Engagement Marketing.

The Challenge: Beyond Transactions

Customer expectations continue to evolve and grow in banking, and it’s evident that traditional approaches of PFM (Personal Financial Management) and marketing banners fall short of the level of personalization that customers desire from their primary institution. Customers expect their primary bank to understand their financial situation and deliver tailored interactions to address their unique needs.

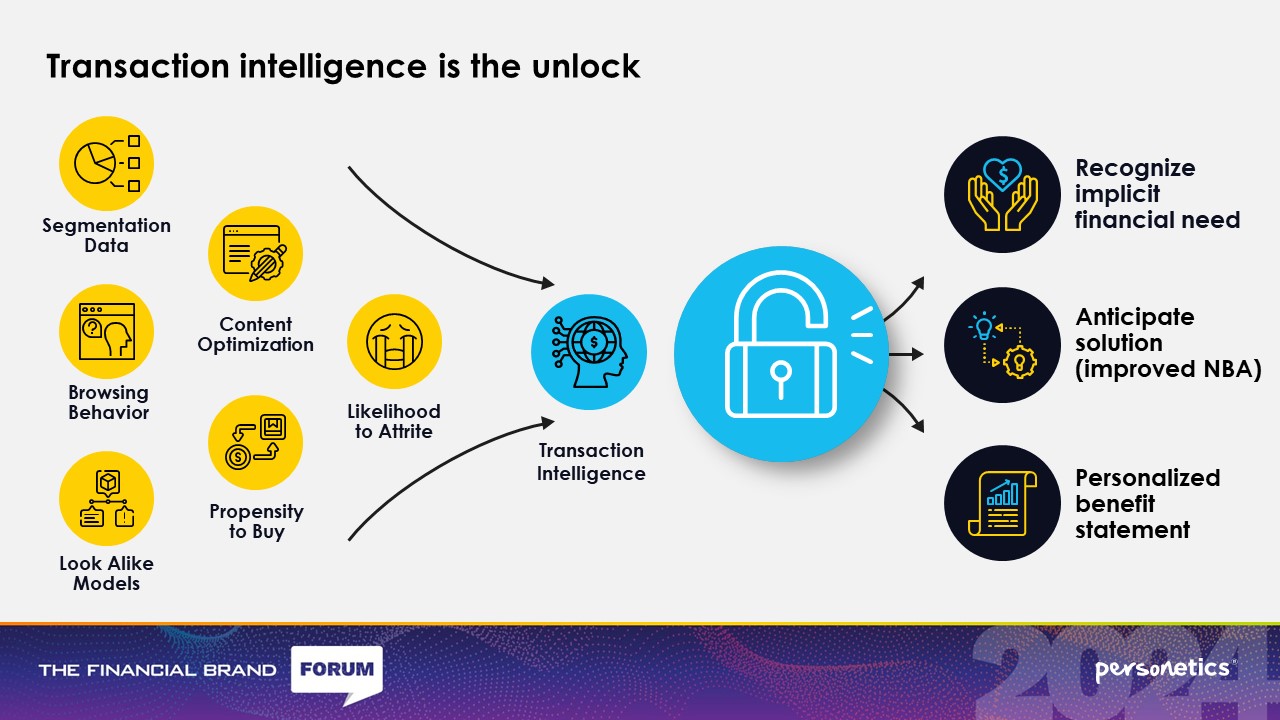

Personalized Engagement Marketing is a concept based on the premise that banks can achieve greater levels of customer relationship depth by acting on the following:

- Anticipating customer needs based on transaction behavior

- Delivering personalized advice based on needs derived from transactions

- Demonstrating evidence of personal benefit by acting on the advice

To be somewhat provocative, I asserted that the “banal” marketing banner will disappear within the next five years (!). It will be replaced by personalized advice delivered through insights that demonstrate evidence of individual customer benefit.

Let’s consider a few simple examples. Consider a customer who frequently uses their debit card for the majority of purchases. Personalized Engagement Marketing doesn’t simply show a pre-approved credit card offer. Rather, it conveys precisely the benefits the customer will earn based on their transaction activity if they were in this better-suited premium credit card solution. Let’s take another customer, for example, who is a frequent user of non-bank P2P payment solutions. Personalized Engagement Marketing conveys the convenience, simplicity and value of replacing their specific transactions with a Zelle solution delivered directly through the bank.

Personalized Engagement Marketing builds a deeper connection with customers by understanding their implicit financial needs and offering proactive guidance. Customers receive valuable advice that helps them better manage their finances; banks build stronger, more loyal customer relationships.

A Shared Vision: Empowering Every Customer

At Personetics, we believe in the power of transactional data-driven personalization to help every customer make smarter financial decisions. We’ve seen the impact from partnering with leading banks in North America that are leveraging AI to create a more engaging banking experience.

Synovus- A Model for Engagement-Driven Banking

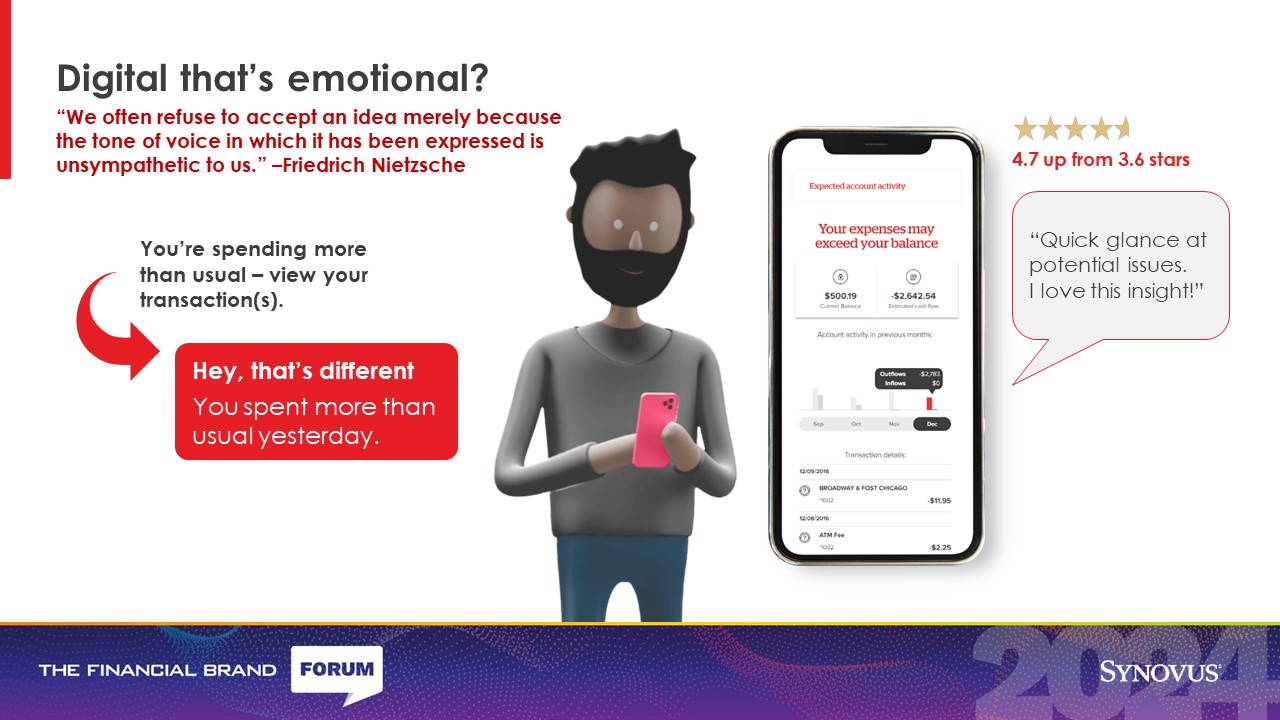

Under Liz’s stewardship, Synovus Bank has set high ambitions for the role of personalization in reframing customer relationships. The bank is innovating how personalized insights are delivered to customers – learning how customers are responding and iterating to increase the level of engagement and trust.

Hear from Synovus’ Liz Wolverton directly:

Liz shared compelling examples of how the bank is optimizing the content and tone of messaging to help customers better embrace personalized insights. It goes beyond the digital channel; Liz shared her ambition for using customer intelligence to engage customers across all channels and to better deliver on Synovus’ brand promise to customers.

The Power of Personalized Guidance: Real Results

While the industry hasn’t yet achieved widespread adoption of new methods of customer engagement through data-driven personalization, industry leaders like Synovus Bank are demonstrating how it can deliver real improvements in customer satisfaction, engagement, and relationship depth.

These results highlight the power of financial data-driven personalization in driving customer engagement and loyalty.

Customer Engagement: Make it Integral to Your Strategy

The initial success of Synovus’ engagement approach is a testament to how they’ve made it integral to their overall customer strategy. Their intensity around learning from customer behavior and continuously improving insight interactions are evidence that the bank is taking customer engagement to the next level.

For regional banks, community banks, and credit unions, there is a logical maturity path to follow as part of a data-driven personalization journey.

- Understand implicit customer needs: Cleanse, categorize, and enrich customer data to identify customer needs based on transaction behavior

- Deliver personalized insights: Implement a platform to deliver personalized insights for your customer base and demonstrate the bank is looking out for them

- Propagate customer intelligence: Capture customer needs and intelligence and deliver across the enterprise to better inform banker interactions and marketing initiatives

- Deliver unified advice across channels: Orchestrate personalized interactions across digital, banker, and marketing channels to demonstrate to customers you understand their needs and are delivering personalized guidance.

By following this maturity path, banks can create a data-driven engagement strategy that tangibly demonstrates to customers that the bank is helping improve their financial well-being.

Ready to Explore How Personetics Can Help?

If you’re looking to unlock the power of financial data-driven personalization and take your bank’s personalized engagement to the next level, Personetics can help. Request a demo today and learn how we can empower your customers to achieve their financial goals. Boost engagement and amplify business impact. https://www-us.personetics.com/contact/

Please read the full Synovus-Personetics case study, which will delve deeper into their journey.

Download the Synovus-Personetics Case Study

Latest Posts

How to Monetize AI While Building Trust

Cognitive Banking, Primacy, and the New AI Playbook for Banks: Insights from Money 20/20

How to Prevent Churn & Grow Wallet Share: Bank Primacy Playbook

How to Maximize SaaS Value and Future-Proof Your Platform

Truist's Performance Marketing Journey: From Merger Challenges to Million-Dollar Results

How Asia Pacific Banks Are Redefining AI-Driven Engagement

Jody Bhagat

President of Americas, Personetics

Jody brings deep operating experience in financial services – managing direct channels, launching digital ventures, and leading digital transformation programs. He was previously a Partner at McKinsey & Company, where he helped financial institutions define and execute digital transformation programs to drive customer growth and operating efficiency. Jody also served in senior digital operating roles at U.S. Bank, Wells Fargo, and Providian. In these positions, he led digital sales and service functions and direct to consumer businesses to deliver organic growth and enhanced customer experience. Jody has an MBA from Northwestern University and a BS in Computer Engineering from The University of Michigan.