March 27, 2025

Huntington Bank: A Masterclass in Data Enrichment and Customer Engagement

By Jody Bhagat, President Global Banking, Personetics

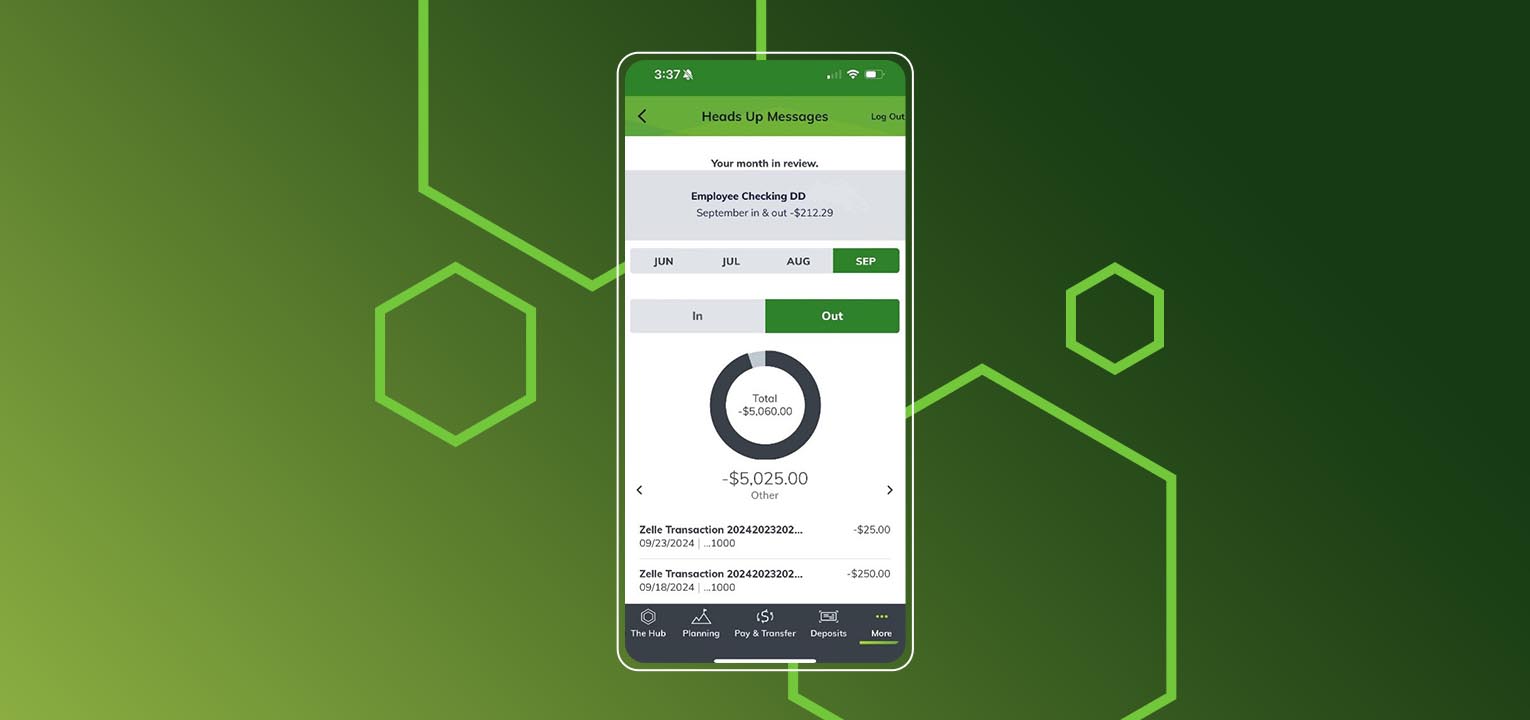

When Huntington Bank listened to their customers about digital banking needs, one message came through clearly: “Make it easy for me. Dig through my data and surface the important things so I don’t have to do it.” In a recent conversation with Joe Proudfoot, SVP of Digital Product and Capabilities, he shared how this $200 billion super-regional bank turned that simple mandate into a program called “Huntington Heads Up” delivering 14 million curated insights every month.

The Scale of Personalization

Huntington’s numbers tell a compelling story: those 14 million monthly insights span 96 different use cases, while maintaining a remarkable 4.7 out of 5 customer satisfaction rating. This success grew from their methodical investment in data infrastructure and orchestration capabilities over the past 12 months.

“When customers told us ‘Show me information that’s complete and accurate,’ we knew we had to rethink our entire approach to data,” Proudfoot emphasized. This customer-first mindset has guided Huntington’s approach to data enrichment and personalization.

Making Data Work Smarter

Huntington’s focus on data enrichment has yielded practical benefits beyond customer satisfaction. “We look at the number of customers who actually call in to file a claim on a transaction they don’t recognize, only to find out when they talk to a claim specialist that they actually did make that transaction – they just didn’t recognize what it was because the data wasn’t good enough,” Proudfoot explained. By making transactions more recognizable, the bank reduces unnecessary service calls while building customer confidence.

The Journey Forward

Huntington is now migrating to a new SaaS solution to strengthen their capabilities. This modernization reflects the bank’s commitment to keep pace with rapidly evolving technology while maintaining their commitment to customer service. “In banking technology, five years is a lifetime,” Proudfoot said. “By moving to Personetics’ SaaS solution, we’re not just modernizing – we’re setting ourselves up to innovate faster and deliver more value to our customers.”

Beyond Core Banking

What’s particularly exciting about Huntington’s approach is their vision for the future. They’re moving beyond basic transaction insights to deliver Huntington-branded, contextualized recommendations using their own unique data attributes.

As Proudfoot explains, “One of the things that really got me excited about the next generation is we actually have the ability to take it a step further and start to bring in our own Huntington-specific data attributes. We can start to deliver Huntington-branded, more personalized recommendations and guidance very specific to our Huntington customers and our Huntington brand.”

The bank is especially focused on helping customers achieve their financial goals. “If a customer has told us they’re trying to save for a down payment on a car,” Proudfoot notes, “as they start to near that goal, what better time to engage them to help them understand what offerings we have to help them get a loan for that car? It’s about orchestrating our data to deliver those insights to help them achieve their goals while also leading to a deeper and broader relationship with Huntington.”

The Power of Personalization

Huntington’s success demonstrates that large banks can deliver highly personalized experiences while maintaining efficiency and scale. Their investment in modern data infrastructure, coupled with their focus on practical customer benefits, shows how banks can create stronger banking relationships through intelligent use of data.

Looking ahead, Huntington continues to invest in this space, recognizing that the future of banking lies in delivering timely, relevant insights that help customers achieve their financial goals while creating opportunities for deeper relationships. As Proudfoot emphasizes, “The biggest thing for the customer is to help me make the most of my money. We’re trying to continually drive more insights to our customers across multiple products in order to help them make the most of their money.”

The results speak for themselves – proving that when banks invest in understanding and anticipating customer needs, everyone benefits. As virtual banking evolves and AI capabilities expand, Huntington’s approach offers a compelling roadmap for the future of customer engagement.

Watch the full conversation with Joe Proudfoot now on-demand.

Want To See How Cognitive Banking and AI Can Transform Customer Engagement?

Request a Demo Now

Latest Posts

Meet Personetics at North America Banking & Fintech Events in 2026

Meet Personetics at LATAM Banking & Fintech Events in 2026

Meet Personetics at APAC Banking & Fintech Events in 2026

How to Monetize AI While Building Trust

Cognitive Banking, Primacy, and the New AI Playbook for Banks: Insights from Money 20/20

How to Prevent Churn & Grow Wallet Share: Bank Primacy Playbook

Jody Bhagat

President Global Banking

Jody brings deep operating experience in financial services – managing direct channels, launching digital ventures, and leading digital transformation programs. He was previously a Partner at McKinsey & Company, where he helped financial institutions define and execute digital transformation programs to drive customer growth and operating efficiency. Jody also served in senior digital operating roles at U.S. Bank, Wells Fargo, and Providian. In these positions, he led digital sales and service functions and direct to consumer businesses to deliver organic growth and enhanced customer experience. Jody has an MBA from Northwestern University and a BS in Computer Engineering from The University of Michigan.