December 2, 2021

Banks Have Digital Engagement All Wrong. It’s Time for A New Model

Personetics is proud to feature this guest article from our partner, Ron Shevlin at Cornerstone Advisors.

24 hours after a routine blood test, you have a comprehensive picture of your physical health. There are hundreds of markers showing whether you are high or low in key nutrients and measuring changes in your blood cells. Regular blood tests can catch the warning signs of almost any disease early.

It’s astounding to me that there’s no equivalent financial check, giving us a quick and accurate picture of our financial wellbeing. At most, you can run a credit score. Or you can pay a financial advisor to analyze your finances – for a price.

But for savvy, forward-looking banks, there’s an opportunity here to develop a new model for customer engagement – one focused on giving people the information they really need to understand their financial situation and tailored advice to improve it. Ironically, while this will create a much stronger emotional bond between banks and their customers, the key to delivering this is Artificial Intelligence.

Over the past decade, it’s become much harder to understand the extent to which customers are engaging with their bank, and how meaningful those engagements are. Back in the good old days, customers came into a branch and spoke to a teller. There was only one channel to monitor (and since no one wore masks, we could even tell what they were feeling relatively easily).

Nowadays, customers not only engage in-branch but through call centers, mobile apps and websites. We’ve made huge ground making these channels more user-friendly and attractive to customers, for example optimizing digital account opening, the onboarding process, service utilization and relationship growth.

Bank customers are not very engaged on digital channels

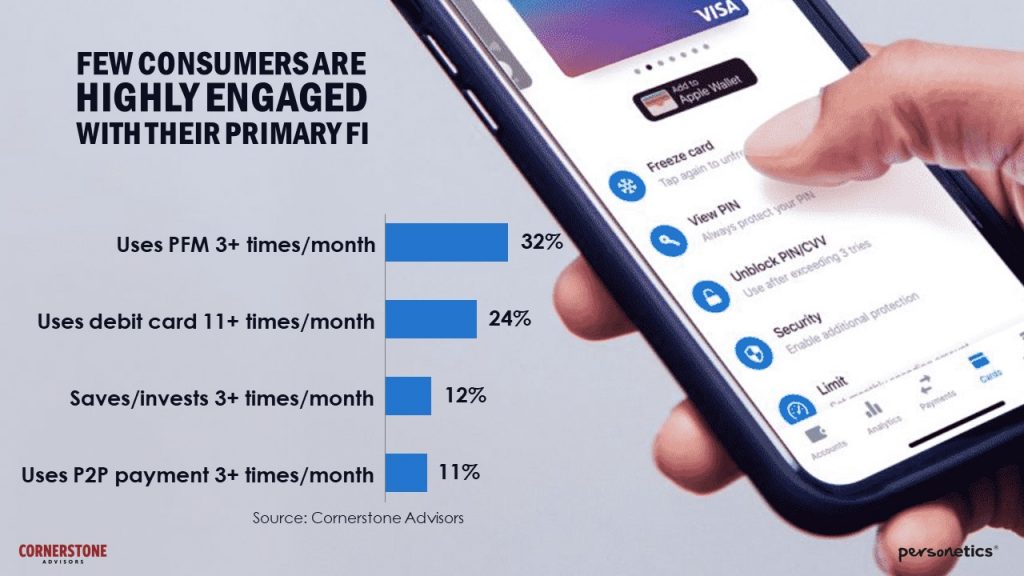

But the signs are that we’ve hit a wall with these traditional digital banking tools. Research I conducted last year shows that customers are simply not that engaged:

- More than 1/3 of banks see 75% or more of their digital account applications abandoned

- Only 1/3 of consumers use their bank’s personal financial

management tools 3 times or more each month - Only ¼ use their bank’s debit card 11 times or more each month

- Only 1/10 of consumers use their bank to save or invest at least 3 times a month

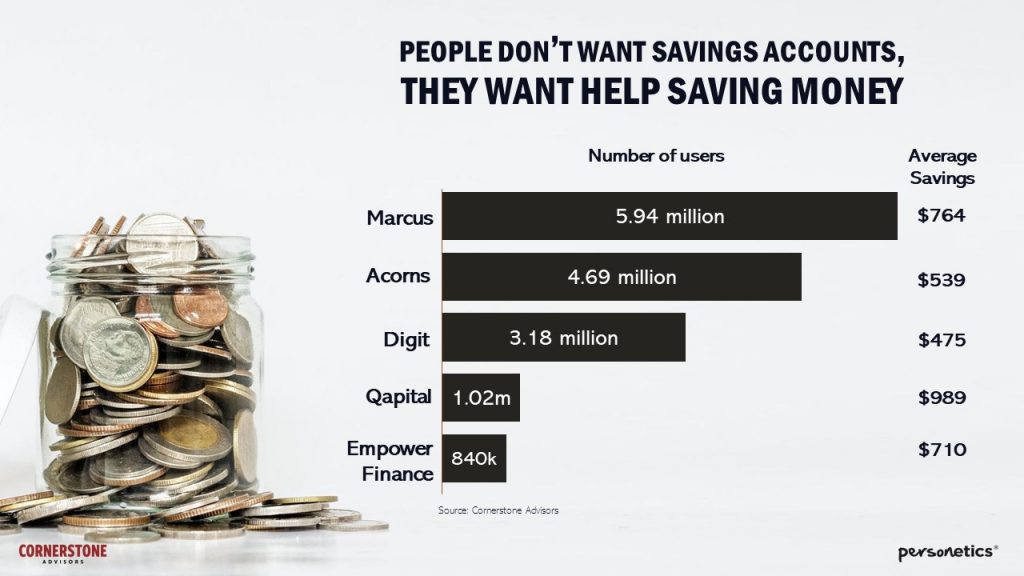

And alarmingly, from the banks’ perspective, customers are using automated AI-driven tools from companies like Marcus, Acorns and Digits to save, on average, $600 more than they would normally – shifting their behavior away from banks.

Interaction isn’t the same as meaningful engagement

The problem is that making banking tools more convenient and user-friendly is not the same as making them compelling or indispensable.

As my colleague, Nicole Myers, VP of Strategic Account Management at Personetics – which has developed a platform for personalized customer engagement for financial services – put it: “Interaction isn’t the same as meaningful engagement.”

Mid-size banks have been slow to recognize this. But it’s urgent that they do because the vast majority of transactions (at least 70%) are now conducted online, yet in North America, under 30% of sales are. Meanwhile, the Big 4 nationals, which deliver more personalized journeys, are winning 51% of new customers.

If the rest of the industry doesn’t learn how to create more meaningful relationships with their customers, they are going to be squeezed further on revenue, margins and market share.

A new model for engagement with banks

The key is to re-imagine what “engagement” really means.

To me, it means creating an emotional connection between the banks and their customers so customers are truly invested in the relationship.

You don’t get that by making it easier for customers to find the right link or encouraging them to check their balance on your app every week.

It comes only by giving customers a service that is genuinely transformative and life-changing. This means helping people gain a deeper understanding of their financial health and make better financial decisions, so they feel more confident about managing their money – and can build a better future for themselves and for their families.

Imagine, for example, that a bank identifies that one of their customers has recently significantly increased their spending in Home Depot and other home improvement stories. They are clearly beginning an extensive home renovation project.

Instead of leaving them to their own devices, the bank could approach that customer with a solution to help them with home improvement financing. This could be initiated digitally, but if the bank knows that customer has a preference for branch visits, a banker could reach out to the customer in person. Once they’ve made an appointment, they can discuss their financial options – perhaps discovering that they can afford a larger renovation than they originally planned, or that they can do the changes they wanted with less financial stress than they envisaged.

‘We noticed your pay rise – Would you like a financial check-up?’

Or perhaps a bank recognizes that a customer has recently had a big pay rise, bonus or an additional income source. It might even notice that the customer has started moving money into a 3rd party investment institution. A financial advisor could again reach out to offer a free financial check-up or to explore with the client the best way to invest the money – making it easier for them to save for retirement, fund their children’s education or pay off their mortgage.

This is completely different from the way a bank might engage with clients now over digital channels, for example pushing a product which “customers like you were interested in” based on an algorithm.

The solution is personalized. The customer understands why they’re being offered new products, and is more likely to embrace them because they can see that it’s genuinely in their financial interest.

You can imagine the gratitude that these customers will feel to their bank for delivering such value, leading to greater loyalty, deeper relationships, higher satisfaction levels – and of course to more business. Banks could even use these capabilities to attract new customers.

Data-driven personalization is already at a tipping point

Until recently, these scenarios would have been pipe dreams. Banks simply did not have the resources to deliver financial wellness programs at scale.

That’s where Artificial Intelligence comes in. Much of the technology already exists and is in use by the largest banks. The rest will be with us within 3-5 years.

The first step – which is almost already table stakes – is cleansing and enriching customer transaction data, so banks can understand what is happening with that customer at any given point in time.

Next, banks must apply algorithms to forecast customers’ cash flow needs in the future, based on their past patterns of activity.

Finally, in the future, banks will be able to apply their own models to figure out what offers to make to customers based on this data – and what channel is most appropriate to reach out to them on, digital or in-branch. Jody Bhagat, President of Americas at Personetics, calls this “Connected Channels.”

“55% of the top 40 American banks have either already implemented some form of data-driven personalization or are in the process of implementing them. We’re at the tipping point in terms of this capability,” he adds.

That’s why mid-size banks need to act now to adopt the same digital engagement technology and adapt it for their own needs. Wait much longer, and the heads of those banks will discover in a few years’ time that their customers are fully engaged – with the competition.

To learn more on how to achieve business impact using AI-Driven Engagement, click here to watch the full webinar we conducted with Ron Shevlin and Jody Bhagat.

Click here to schedule a call with one of our experts.

Want To See How Cognitive Banking and AI Can Transform Customer Engagement?

Request a Demo Now

Latest Posts

Meet Personetics at North America Banking & Fintech Events in 2026

Meet Personetics at LATAM Banking & Fintech Events in 2026

Meet Personetics at APAC Banking & Fintech Events in 2026

How to Monetize AI While Building Trust

Cognitive Banking, Primacy, and the New AI Playbook for Banks: Insights from Money 20/20

How to Prevent Churn & Grow Wallet Share: Bank Primacy Playbook

Ron Shevlin

Director of Research at Cornerstone Advisors

Ron Shevlin is the Managing Director of Fintech Research at Cornerstone Advisors, where he publishes commissioned research reports on fintech trends and advises both established and startup financial technology companies. Author of the Fintech Snark Tank on Forbes, Ron is ranked among the top fintech influencers globally, and is a frequent keynote speaker at banking and fintech industry events. Want to talk more fintech? Connect on Twitter or LinkedIn.