September 12, 2021

From Transactions to Trusted Advisor: Why Open Banking 2.0 is a Game-Changer for Financial Services

Open banking has the potential to be the third wave of true innovation in financial services, with big opportunities for banks to develop a holistic view of their customers’ finances and create deeper, more profitable lifetime customer relationships.

Let’s take a closer look at how your organization can put itself in a strong position to capitalize on the future of open banking.

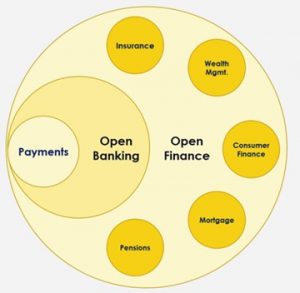

Embracing Open Banking 2.0, Moving to Open Finance

In recent years, many financial institutions have been talking about open banking and expressing support for it, but very few are actually capitalizing on the opportunities. We are seeing the industry move rapidly from the early stages of Open Banking 1.0 (first developed as a regulatory framework in the European Union and the UK) to a more sophisticated level of Open Banking 2.0.

In Open Banking 1.0, 16 countries started the first initiatives of open banking, with a focus on the infrastructure, regulatory framework (first developed in the EU and UK), and developing the right standardizations for how to use shared APIs to give customers more options and flexibility over how to use their financial data.

Today more than 60 countries worldwide are using open banking. With Open Banking 2.0, not just banks but fintechs, wealth management firms, insurance companies, and other financial institutions are looking to create business impact by better understanding their customers. A recent article from Forrester offers examples of how Open Finance is creating new opportunities in several verticals:

- Insurance: better data-sharing could help insurance companies evaluate risk more precisely and give customers dynamically adjusted premiums with personalized actuarial models. If you choose to travel at less-risky times of day or on lower-risk roads, this could be reflected in your car insurance costs.

- Inclusive Credit Products: open banking could help identify new inclusive credit offerings for underserved customers, by using shared data from delivery and ride-hailing apps. This can help banks manage credit risk and identify creditworthiness for customers who might be excluded or underrepresented by conventional credit reporting agencies.

- Contextualized, Personalized Suggestions: Open banking and open finance will help pull data together in real-time across multiple sectors and create personalized insights and recommendations. Whether a customer needs a loan, mortgage, investments, insurance, or other financial products, open banking can help banks serve as a trusted advisor to recommend the right product at the right time.

Open banking and open finance are applicable to all sorts of segments, including retail and small business banking. With open finance, financial advisors and relationship managers can have a better holistic view of customers and execute against it, deepening the customer relationship for bigger lifetime customer value.

Open Banking: Transforming Banks from “Ego”-System to Ecosystem

Too many banks have taken a transactional mindset to customer relationships. Instead of focusing on the “ego-driven” act of selling, of maximizing every short-term profit opportunity, banks more than ever are obligated to fulfill their social contract with their clients and contribute to a larger “ecosystem” of financial services that serves the economy and the public interest on a broader level.

Open banking and open finance are not just about better-managing risks or identifying individual sales opportunities. They are about taking a more aggregate view of the customer’s financial life and behavior so that the bank can focus on service to that customer’s needs, and serve a higher-value purpose for their customers. By being a trusted advisor, by being a source of proactive insights, personalized recommendations, and product-based advice that creates value across the customer’s entire financial life, banks can create more value for customers and for society.

The bank needs to be able to say to the customer, “We want to help you succeed. If you will share some data with us, if you connect us with your other external accounts, your retirement account, your investments, your credit cards, we will help you manage your financial life. We will become your real-time trusted advisor.”

This is the inevitable evolution of financial institutions in the world of Open Banking 2.0. Not a transactional approach, selling one new loan or opening one new account at a time; but a trust-based advisory service approach. This is how banks can increase the openness of their customers, know their customers, deepen their customer relationships, and enhance their customers’ trust.

Best Examples of Open Banking Use Cases

Several companies are driving the future of Open Banking 2.0.

- Akoya: The Akoya Data Access Network provides a standardized way for financial institutions, fintechs, and data aggregators to securely share API-based access to financial data from mutual customers. With Akoya’s APIs, bank customers do not have to share login credentials to be able to share their data with third-party apps. Akoya is an interoperable solution for the entire financial services industry and is backed by 12 major U.S. financial institutions. Better industry-wide standards like Akoya are making it easier for banks to adopt open banking.

- Raisin: this fintech startup based in Germany offers a “savings-as-a-service” toolkit to help banks create customizable, dynamic deposit products. They provide small banks with access to products and services from other banks. If your bank is not able to offer the most competitive deposit product, Raisin enables your bank to provide your customers with higher-yield deposit solutions from other banks. As a bank customer, you don’t care where the product comes from; you just want the best yield on your savings. Raisin helps banks maintain and expand their customer relationships by offering access to customizable products. Banks can use open banking to compete over customers with alternative products and solutions that do not have to be developed internally by the bank. With Raisin, your bank can become a financial powerhouse marketplace, connecting your customers to products and solutions from other banks. But to accomplish this, first the bank has to understand the customer’s complete financial picture.

- Ally Bank: this U.S. digital bank uses Personetics’ Act Cloud to offer Surprise Savings, an automated savings tool that helps Ally Bank customers save for the future by identifying safe-to-save pockets of money by connecting with the customer’s external bank accounts. The customer doesn’t have to take any actions or set any goals; Act Cloud automatically moves the money from the customer’s checking account to their Ally savings account at the right time based on the algorithm. Personetics’ Act Cloud solution is completely automated, self-adjustable, and part of our self-driving finance vision.

Why Personetics is Ready to Lead in Open Banking Open Finance

At Personetics, we believe that our focus, our vision, and our approach is at the center of the biggest opportunities of Open Banking 2.0. That’s because we help banks build trust with customers, develop a holistic financial map of their customers’ financial lives, and ultimately create a more expansive relationship between the bank and its customers.

We understand the value of open banking and open finance for personal finance and money management. We have solutions to create highly personalized engagement between financial institutions and clients:

- Personetics Act Cloud is an automated, self-adjustable financial wellness solution to help customers reduce debt, save, or invest funds toward one or multiple goals. It enables banks to offer solutions tailored to the customer’s individual ability to save or invest at any given time.

- Personetics Engage offers AI-based personalized insights, alerts and advice for customers to improve their financial wellness.

- Personetics Enrich helps financial institutions categorize, clean, and enrich their customers’ transaction data to deliver effective cross-selling and a superior customer experience.

The biggest, most important reason for banks to invest in open banking and to share customer data is not just for individual transactions, but for a total picture of the customer’s financial life. Personetics can help open up bigger opportunities for banks to recommend products and generate bigger customer lifetime value.

Beyond payments and banking, open finance is creating a wave of new opportunities in multiple sectors and verticals, including:

- Insurance: Open finance will enable insurance companies to share data more easily than (with the customer’s permission) can be used to gauge the customer’s risk levels, detect major life events, and create opportunities for contract discovery.

- Wealth Management: in the new world of open finance, wealth managers and financial advisors can more easily share data to identify the suitability of clients and create personalized financial advisory products.

- Consumer Finance: Open finance will make it more possible for nonbanks to create financial products and services for their customers, such as unsecured lending products. The definition of what is a “bank” is changing in the direction of greater innovation and inclusion.

- Mortgages: Open finance can create opportunities for easier, faster mortgage underwriting, based on more seamless access to customer data between banks and lenders.

- Pensions: With open finance and data sharing, pension providers and retirement planners can achieve more accurate forecasting and automated advice, based on portfolio performance, customer income and spending levels, and more.

Personetics is positioned at the center of all of these use cases and is a leading force in driving these trends toward open finance. We help develop open finance solutions for a wide variety of financial institutions and financial service providers. Our platform helps organizations quickly get access to data, provide data on the fly, and execute against data with personalized engagement, personalized content, product-based advice, and self-driving finance to automatically move money and invest money.

Whether you’re a bank, a mortgage issuer, or a wealth management advisor, Personetics helps financial institutions to improve their customers’ financial wellness and elevate the role of the financial institution as a trusted advisor in the customer’s life.

Open Banking: Raising the Standard

Personetics believes that open banking is elevating the standard and vision of what banks can do for customers. We are at the forefront globally of driving these inevitable trends.

Banks are ultimately selling trust. Money is a psychological thing; people care about money because it helps them fulfill their needs and achieve their dreams. They want trusted advisors who can help them achieve those dreams. Banks should be standing by, ready to serve in this role as their customers’ trusted advisors.

Open banking can give banks the data that they need to be trusted advisors if the banks can get the right help to know how to use it. Personetics helps banks maximize the opportunities of open banking. We help banks analyze, sort and find insights in the data – and give banks the automatic, self-driving finance solutions that their customers need to be successful.

Financial institutions should want to move up the value chain and deliver higher-level services to their customers. Instead of just being a source of transactions, a new credit card or a new loan origination, banks need to become holistic financial advisors. Open banking is the opportunity for banks to become more efficient, add more value for the customer, and automatically help the customer save, invest, or get pre-selected for loans or other products. Open banking can help banks stay at the center of the customer’s financial life, and maximize the customer’s lifetime relationship value.

Open banking and open finance are inevitable, overwhelming trends, and for forward-thinking companies, the future of open finance is here now. Banks and other financial services organizations that embrace open finance will have an opportunity for a significant advantage over their competitors while building deeper lifetime relationships with customers.

Is your organization ready for Open Finance? Talk to Personetics today.

Personetics’ clients: Please contact your dedicated Customer Success Manager to learn how to leverage Open Banking with Personetics.

New clients: If you want to be a member of the Personetics community, please request a demo and one of our Solution Experts will reach out to you shortly.

Want To See How Cognitive Banking and AI Can Transform Customer Engagement?

Request a Demo Now

Latest Posts

Meet Personetics at North America Banking & Fintech Events in 2026

Meet Personetics at LATAM Banking & Fintech Events in 2026

Meet Personetics at APAC Banking & Fintech Events in 2026

How to Monetize AI While Building Trust

Cognitive Banking, Primacy, and the New AI Playbook for Banks: Insights from Money 20/20

How to Prevent Churn & Grow Wallet Share: Bank Primacy Playbook

Dorel Blitz

VP Strategy & Business Development

Dorel Blitz brings over 13 years of experience in global strategy and business development in the financial services industry. Dorel joins Personetics from KPMG, where he headed the Fintech sector at KPMG Israel and a member of the global Fintech practice. In this role, Dorel was instrumental in establishing KPMG’s collaborative relationships with global financial institutions and leading Fintech companies including Personetics. He also acted as a subject matter expert and led advisory projects involving digital transformation strategies with financial services organizations. Prior to joining KPMG, Dorel led the Innovation & Fintech practice at Bank Leumi, and earlier in his career, he headed the banking & finance division at global research firm Adkit.