October 14, 2020

Reinventing the Mass Affluent Banking Journey with Personalized Engagement

A critical group of retail banking customers generates 70% of total profits, according to PWC. This group averages $750,000 in investible assets and an average household income above $75,000. Its members, consisting of Baby Boomers and older Millennials, have enough wealth to act on multiple financial goals, including saving for retirement or college tuition, planning a vacation, or reducing debt.

These customers are known as “Mass Affluents”: they have money to invest and save and may benefit from advice on what to do with it. They require a more automated and streamlined way to manage their wealth because they lack the time to do so manually on their own. Specifically, they expect their bank to help them:

- View their financial activity simply, transparently, and holistically;

- Receive personalized, proactive advice and investing services — as they receive from other data-driven digital products they regularly use;

- Set and progress toward lifetime financial goals.

In other words, Mass Affluent customers are ready for a private banking experience. But delivering on that may be financially unviable for banks. How can banks deliver an experience that parallels private banking at scale to this highly profitable customer group?

Personalized Engagement for the Mass Affluent: Why?

The increasing availability of digital, data-driven solutions presents an opportunity for banks to serve Mass Affluents on a personal level like never before. By tailoring services to this highly digitized population, banks stand to gain wallet share, loyalty, and more customers who bump up to the next wealth category, high net worth.

If they fail to do so, banks could lose Mass Affluent customers to competitors, from external wealth management firms like Vanguard or Fidelity, to other retail banks with more evolved digital offerings, to a growing number of fintechs supplying digital banking services. Personetics is here to help banks deliver the level of service Mass Affluent customers expect, quickly and at scale, through a suite of data-driven, personalized, automated services uniquely tailored to the needs of this group.

The Personetics Journey – What Personetics Can Do For You

With Personetics, banks differentiate for Mass Affluent customers through meaningful, financial data-driven, personalized wealth insights that optimize the banking experience;

Insights: A Meaningful Picture of Financial Health

Personetics delivers curated insights directly to Mass Affluent customers and their relationship managers (bankers and financial advisors) through digital channels. Types of insights include:

- Investment insights monitor customers’ investment portfolios and make personalized recommendations.

- Tax benefits and retirement insights recommend tax-advantaged accounts and encourage retirement contributions based on a customer’s capacity to set aside funds.

- Lending and refinancing insights provide relevant lending offers and notifications tied to customer needs.

- Service recommendations deliver a set of money transfer recommendations, service, and product offers based on the customer’s activity.

- For customers with linked accounts between financial institutions using Open Banking protocols, the bank can deliver guidance based on external financial activities such as cash optimization, debt reduction, and more informed product offers.

- The bank can offer Mass Affluent customers brokerage-based insights and insights relating to portfolio changes in investment accounts.

Tailored Advice to Build Wealth

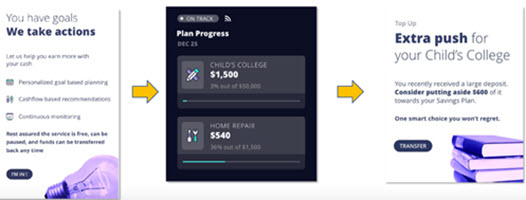

Meaningful insights provide a strong basis for trust-building between the bank and its Mass Affluent customers. But a bank that wants to retain those customers’ loyalty and increase their wallet share must enable those customers to act on those insights. Personetics engages customers by evaluating their real-time eligibility for a product or service, generating relevant offerings, and delivering them when they are most needed. Contextual digital sales result in stronger product performance: a 17% click-through rate for these offerings.

Automated Programs: Managed Accounts at Scale

Automated financial wellness programs present an alternative to privately managed accounts, allowing banks to send the message at scale to their Mass Affluent customers that they are genuinely cared for. Using an algorithm-based framework and predictive analytics, programs invite targeted customers and guide them through dynamic, personalized journeys to build wealth and achieve their long-term financial goals, leading more customers to have primary relationships with the bank (such as core accounts, wealth accounts, and cards).

Programs evolve alongside customers. An affluent young family may be offered to join an automated college savings program. As their income rises the bank will suggest joining an investment program. The highest earners could be offered to join “Pay Yourself First”, in which Personetics identifies regular income deposits and helps the customer save or move some of those deposits automatically. If a customer has multiple goals, the system can suggest multiple programs and advise how much to deposit in each one.

More Meaningful Relationship Management

A critical element of the financial journey for Mass Affluent customers lies in how they experience their relationship with the bank. Personetics’ data-driven insights, advice, and automated programs empower banks’ Relationship Managers (RM) to serve Mass Affluent customers at scale. The RM has access to the insights described above, as seen by the customer and when the customer reaches out, the RM is better equipped to help, and can offer meaningful products and services that continue the conversation seamlessly, deepening the relationship in an authentic way. Even better, the RM is equipped to proactively reach out and offer insights to the customer before they ask for support.

The Added Value: Data-Driven Trust & Engagement at Scale

Aspects of these solutions may appear familiar. Personal Financial Management solutions like budgeting tools and rounding-up transfers, while increasingly standard, have seen limited adoption rates because they are not based on real-time financial data and don’t address a customer’s point in time needs. In contrast, Personetics’ unparalleled library of more than 300 insights and the Engagement Builder custom insight, codeless, building tool are linked with customers’ real account data, enabling truly valuable engagement. Personetics’ algorithms account for changing financial realities, suggest action accordingly, and even automate those processes for the customer. Together, these capabilities contribute to an unprecedented level of sophistication, driving trust and engagement which translate to improved business outcomes:

- Higher customer trust – 5%-8% increased retention

- Improvement in perceived value – 7-point growth in NPS rating

- Greater product adoption – 31% of funds deposited as a result of insights and advice originate from external accounts

Personetics’ solutions allow banks to achieve scale when it comes to their Mass Affluent customers, handholding and guiding through their financial journey and overcoming the constraints of delivering personalized advice in person. It’s what banks need to tap into the potential of this substantial—and growing—customer segment.

Want To See How Cognitive Banking and AI Can Transform Customer Engagement?

Request a Demo Now

Latest Posts

Meet Personetics at North America Banking & Fintech Events in 2026

Meet Personetics at LATAM Banking & Fintech Events in 2026

Meet Personetics at APAC Banking & Fintech Events in 2026

How to Monetize AI While Building Trust

Cognitive Banking, Primacy, and the New AI Playbook for Banks: Insights from Money 20/20

How to Prevent Churn & Grow Wallet Share: Bank Primacy Playbook