May 30, 2021

The Digital Banking Data Driven Personalization Strategy

In recent years more forces are joining the hyper-personalization battleground in the digital banking space. Tech giants like Google and Apple introduced Google Plex and Apple Card. Alipay already controls a sizeable number of Chinese financial transactions and is now also offering loans and insurance. Neobanks and digital banks like Revolut, Grab, and Razer offer more relevant solutions to their customers. And, of course, incumbent banks have upped their technology and digital investments to compete in this crowded field and provide robust personalization to their customers.

Banks should invest in four areas to achieve meaningful data-driven personalization that drives business results:

- Cleansed and Enriched Data: Banks amass customer transaction data from multiple sources, such as payment systems, credit and debit cards, and external accounts (where Open Banking regulations allow). They must invest in cleansing, categorizing, and enriching transactional data, adding, for example, the merchant’s name, logo, and business details to transactions. Doing so is a critical building block in creating valuable digital customer experiences because data that is not highly accurate is not useful.

Enriching transaction data is a must for a superior customer experience and effective cross-selling targeting. - Personalized Insights: Enriched data can be transformed into meaningful, personalized insights delivered to the customer through an intuitive and modern platform. Imagine a feed on the banking app’s home screen that offers insights to onboard new customers, cash flow predictions, income management, transaction monitoring, a spending tracker by category, summaries of recent travel, cash optimization, saving tips, or subscription services. Because there is so much data being collected, the possibilities for insights are abundant, and banks can give customers a fresh experience every time they log on. Algorithms can determine the right message to send, such as, “You might be short on cash flow to pay your upcoming water bill”) and the right analytics can be used to refine insights e.g., “In previous months, your bill comes on the 17th, and you’re only going to get paid on the 20th”. These kinds of real-time personalized insights quickly increase trust, engagement, and customer receptivity to act upon product-based advice.

- Proactive Advice: Banks can then move customers a step further along the valuable experience continuum by using advanced analytics to proactively advise on financial actions and recommend targeted products and services. For example, offering to transfer funds to savings or investment when a higher salary is detected. Or offering an excellent loan or mortgage refinance when the bank identifies a cash flow problem.

- Wellness Automation: The ultimate promise of digital banks is to significantly impact customers’ financial wellness and resilience. AI programs run daily to analyze spending habits, income, and upcoming expenses, and find safe-to-save funds to transfer into savings, investment, or debt reduction. Programs automatically allocate between the customer’s predefined financial goals.

Confidence-Building Data Driven Banking Insights

Data Driven Personalization that Out Smarts Humans

As humans, our decisions are often driven more by emotion than by logic. When it comes to our finances, we rarely think too many steps ahead, easily forget how much we spent in previous months, and fail to save as much as we could. Machine learning capabilities developed in recent years can analyze our spending and income and create highly accurate predictions about cash flow and savings—more accurate than humans. This allows banks to move from only offering their customers manual procedures to autonomous, adjustable algorithms. At Personetics, we call this “self-driving finance.”

An AI algorithm constantly analyzes the bank’s entire customer population, segments customers, profiles individual customers and then builds a financial map for each one. The algorithm uses that map to determine the best program or product to offer a customer and eventually invites the customer to join an auto-saving, auto-investment, debt reduction, or another program that the bank offers. Once the customer opts in, the program runs daily, predicting cash flow and identifying, at any point in time, money that is safe to move toward a program that will help the customer meet their financial goals. The machine knows the customer better than they know themselves and can make unemotional, better decisions than the customer may make independently, ultimately moving more money into savings than the customer would move manually.

Huntington Bank is a good example of this. Its MoneyScout algorithm moves between $5-50 into customers’ savings accounts, up to three times a week, and alerts customers when funds have transferred. In this way, Huntington customers who may have been too impulsive to transfer money into savings alone have saved up to several hundreds of dollars per month. Open Banking regulations allow banks to take this a step further.

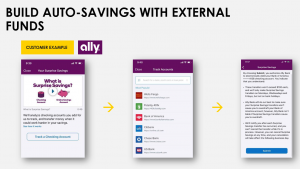

By allowing customers to link their bank account with accounts at external financial institutions, the algorithm will detect safe-to-transfer funds from external sources and increase wallet share. Ally Bank allows customers to connect external accounts in its Surprise Savings program. A significant portion of money transfers in the bank originates from external accounts.

ROI at Every Deployment

An advantage of the data enrichment, insights, advice, and automation continuum is that ROI hides at every step and with each deployment. Personetics has worked with the Royal Bank of Canada (RBC) to implement a variety of personalized insights, advice, smart budgets, small business solutions, and conversational banking capabilities under the bank’s “Nomi” offering, and each has seen its financial benefit for both customers and the bank.

To date, RBC has generated 1.2B insights with high NPS ratings and 100% growth in user engagement—customers went from spending 3 minutes in an average session to 6 minutes. Nomi’s “Find & Save” tool, the bank’s branded automated savings programs, has generated more than 265,000 new accounts, with annual customer savings of $2,400.

Nomi’s AI-driven budgets see 20% penetration with 1.2 million customers using the tool and 2.2 million budgets created in one year. And Nomi’s “Insights for Small Business” tool has been rated first in class in the Canadian market. Indeed, these are the building blocks of a winning playbook.

Contact Personetics to learn how to build your high-performing digital banking strategy.

The full webinar Digital Banking VS. Digital Banks: The Ultimate Challenge can be found here.

To harness your banking customers’ data for a more engaged, proactive conversational banking experience, contact Personetics today.

Want To See How Cognitive Banking and AI Can Transform Customer Engagement?

Request a Demo Now

Latest Posts

Meet Personetics at North America Banking & Fintech Events in 2026

Meet Personetics at LATAM Banking & Fintech Events in 2026

Meet Personetics at APAC Banking & Fintech Events in 2026

How to Monetize AI While Building Trust

Cognitive Banking, Primacy, and the New AI Playbook for Banks: Insights from Money 20/20

How to Prevent Churn & Grow Wallet Share: Bank Primacy Playbook

Shalom Sagi

VP Asia Pacific & Middle East

Shalom Sagi brings more than 20 years of experience in financial software solutions and FinTech growth acceleration, specializing in developing and establishing new business in Asia Pacific. Prior to Personetics, Shalom was leading the APAC business growth for Nice-Actimize, the leading worldwide provider of financial crime, risk and compliance solutions. Prior to Actimize, Shalom led the banking and insurance implementation division at Ness Technologies. Holds B.Sc. in Industrial Engineering and Management from Tel Aviv University.